personal property tax car richmond va

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Restaurants In Matthews Nc That Deliver.

The county also can consider high mileage and damage beyond regular wear and tear in assigning values to vehicles.

. Parking tickets can now be paid online. A vehicle is subject to tax if it is normally garaged or parked in the County even if registered in another State. Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly.

If a vehicle is purchased before the 15th of the month that entire month counts in the proration of the vehicle for tax purposes. Personal Property Taxes are billed once a year with a December 5 th due date. Personal Property Tax.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Is more than 50 of the vehicles annual mileage used as a business. 350100 x 10000 35000.

If you have questions about your personal property bill or would like to discuss the value. Pay Your Parking Violation. Personal Property Tax Rates Vehicles Autos trucks motorcycles and utility trailers are assessed on a prorated basis using the National Automobile Dealers Associations Blue Book NADA value at a rate of 500 per 10000.

Warren County levies a personal property tax on automobiles trucks mobile homes pro-rated quarterly motor homes recreational vehicles boats motorcycles and trailers. Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. Reduce the tax by the relief amount.

105 of home value. Personal Property taxes are billed annually with a due date of December 5 th. Questions answered every 9 seconds.

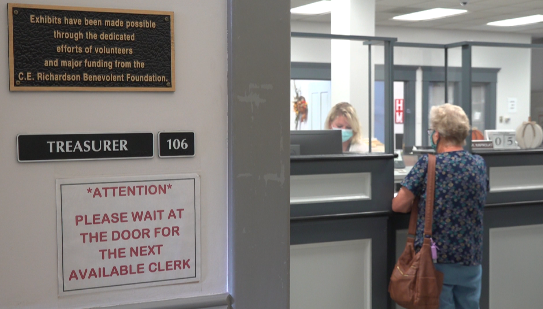

Personal Property Taxes. Delivery Spanish Fork Restaurants. Personal property taxes in Warren County are assessed by the Commissioner of the Revenue and collected by the Treasurer.

Real Estate and Personal Property Taxes Online Payment. Example Calculation for a Personal Use Vehicle Valued at 20000 or Less. Pay Personal Property Taxes.

If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region.

Goochland County residents will have more time to pay their real estate and personal property taxes. It is an ad valorem tax meaning the tax amount is set according to the value of the property. Personal property tax car richmond va.

5 for the tax formally called the tangible personal property tax which actually. Interest is assessed as of January 1 st at a rate of 10 per year. Call 804 646-7000 or send an email to the Department of Finance.

Parking Violations Online Payment. Opry Mills Breakfast Restaurants. The 10 late payment penalty is applied December 6 th.

Click Here to Pay Parking Ticket Online. The governing body of any county city or town may provide by ordinance for the levy and collection of personal property tax on motor vehicles trailers semitrailers and boats. Have a gross vehicle weight of less than 7501 pounds.

For questions regarding mobile homes please contact the Commissioner of the Revenue by phone at 804-748-1281 or via email at Commissioner of the Revenue. 83-year-old dead after crashing car into tree in Hanover. If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed value.

Boats trailers and airplanes are not prorated. See reviews photos directions phone numbers and more for Personal Property Tax locations in Richmond VA. Offered by City of Richmond Virginia.

Personal Property Registration Form An ANNUAL filing is required on all. Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Vehicle personal property tax richmond va.

To qualify for the Personal Property Tax Relief a vehicle must. Be used 50 or less for business purposes. Soldier For Life Fort Campbell.

Be owned by an individual or leased by an individual under a contract requiring the individual to pay the personal property tax. Bills in most Northern Virginia jurisdictions are due Oct. The property taxes on motor vehicles and trailers are prorated based on the date of purchase or the date the vehicle acquires taxable situs in the City of Richmond on an even month basis.

Richmond VA 23225 804 230. Answer the following questions to determine if your vehicle qualifies for personal property tax relief. Frederick County levies a personal property tax on automobiles trucks motorcycles trailers motor homes campers mobile homes boats or watercraft airplanes or aircraft and business personal property.

Assessed value of the vehicle is 10000. Prince William County Government. The County bills personal property taxes in halves.

Motor homes trailers boats and farm use vehicles do not qualify for tax relief. Yearly median tax in Richmond City. Richmond City has one of the highest median property taxes in the United States and is.

Calculate personal property relief. Income Tax Rate Indonesia. Personal Property Tax Car Richmond Va.

Apply the 350 tax rate. The personal property tax is calculated by multiplying the assessed value by the tax rate. 226 for 2021 x 35000 7910.

In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region. Essex Ct Pizza Restaurants.

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

Youngkin Signs Bill To Reclassify Certain Vehicles And Personal Property Tax Rates Wric Abc 8news

Lowering Auto Insurance Rates Stretcher Com Save Money No Matter What Your Credit Score Autoi Cheap Car Insurance Getting Car Insurance Car Insurance Tips

Vehicle Supply And Demand May Lead To Higher Personal Property Taxes In Virginia

Henrico County Announces Plans On Personal Property Tax Relief

Richmond Raises Tax Relief As Vehicle Values Surge Wric Abc 8news

Many Left Frustrated As Personal Property Tax Bills Increase

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

/cloudfront-us-east-1.images.arcpublishing.com/gray/SWWMJLSP2VFM3FNEXXD7CNZA7M.png)

Chesterfield County Personal Property Taxes Skyrocket As Used Car Assessment Values Surge

Many Norfolk Taxpayers Seeing Increase In Personal Property Bills Wavy Com

Many Left Frustrated As Personal Property Tax Bills Increase

Dream Of Homeownership Slides Across The Uk Home Ownership New Home Developments Home

Aba Tax Services Xero Accountant Property Business And S M S F Specialists Business Insurance Small Business Insurance Car Insurance

Henrico Leaders To Vote On Personal Property Tax Bill Extension

Virginia Sales Tax On Cars Everything You Need To Know

![]()

Aba Tax Services Xero Accountant Property Business And S M S F Specialists Business Insurance Small Business Insurance Car Insurance